-

2023-09-21Production LineROHOTEK specializes in SMT, DIP, PCBA and assembly Packaging one-stop production enterprise, the ...

-

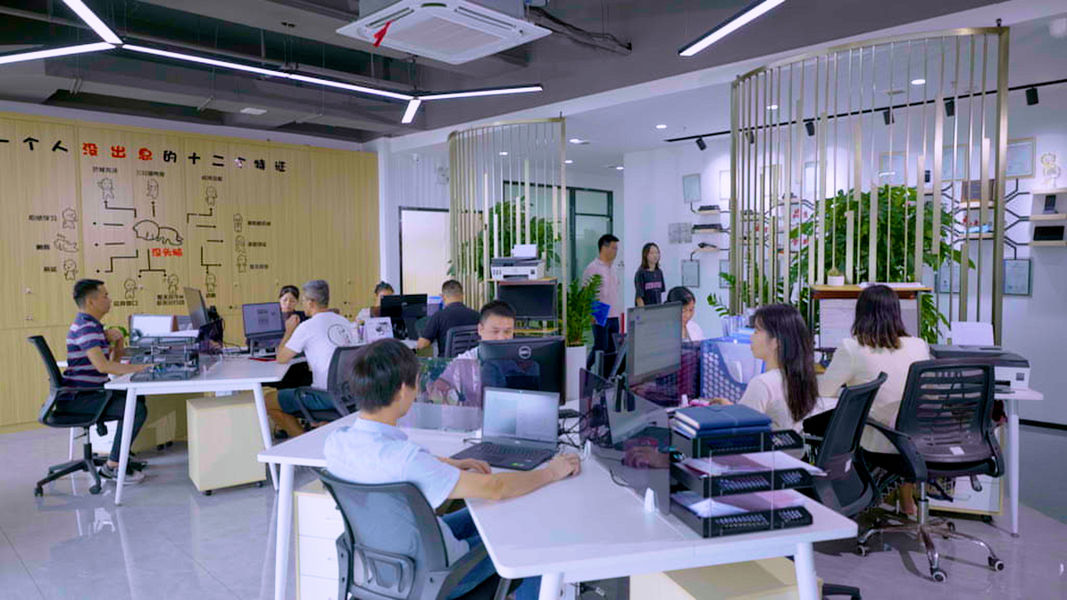

2023-09-21The Introduction Of Our CompanyROHOTEK is a high-tech enterprise focusing on the research and development, production, sales and ...

-

2023-06-24Smart machine shipment ranking in Q1 2023The report pointed out that in Q1 2023, Samsung's smartphone shipments were 60.5 million units, with ...

Leave a Message

We will call you back soon!

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters!

Please check your E-mail!

Please check your E-mail!

SUBMIT

More information facilitates better communication.

Mr.

- Mr.

- Mrs.

OK

Submitted successfully!

We will call you back soon!

OK

Leave a Message

We will call you back soon!

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters!

Please check your E-mail!

Please check your E-mail!

SUBMIT